Wonkiness Alert

Wonkiness Alert

This post is only (or mostly)

for those interested in nonprofit minutiae.

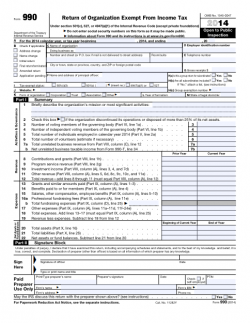

There are two basic types of 501(c)(3) organizations: public charities and private foundations. Private foundations are limited in the deductions available to contributors, are subject to excise taxes, and have a different and more complicated Form 990 (990PF) to fill out. (In addition, they are required to distribute a minimum percentage of their assets every year, but this is not an issue for most nonprofits.) If approved as a 501(c)(3) an organization is a private foundation unless it proves otherwise.

With me so far?

An organization can be classified a public charity under section 509(a) of the tax code. (Gee, this is so much fun!) For those who are still awake and paying attention, here are the four categories of public charities:

- 509(a)(1): “traditional” public charities—broad-based public support (public charity status is based upon public support) as defined, are you ready, by paragraphs 170(b)(1)(A)(i)-(vi)

- 509(a)(2): gross receipts/service provider organizations (e.g., museums, symphony orchestras)

- 509(a)(3): supporting organizations (foundations that wholly support a public charity)

- 509(a)(4): test for public safety

What possessed me to bore my readers with this information was the realization that there are two significant elements of terminology in the tax code of which members of the nonprofit arts community should be aware. One, that is mentioned from time to time, is that the word “arts” does not appear in the language establishing 501(c)(3)’s. The arts must either fall under education or charitable organization.

The other is what I’ve presented here. Every arts organization is, in the eyes of the tax code, a public charity. I think it’s worth our while to consider what that means (or should mean) in the ways we conduct our business and interact with our communities.

If you made it this far, congratulations. Now go do something that can be considered summer fun.

Engage!

Doug